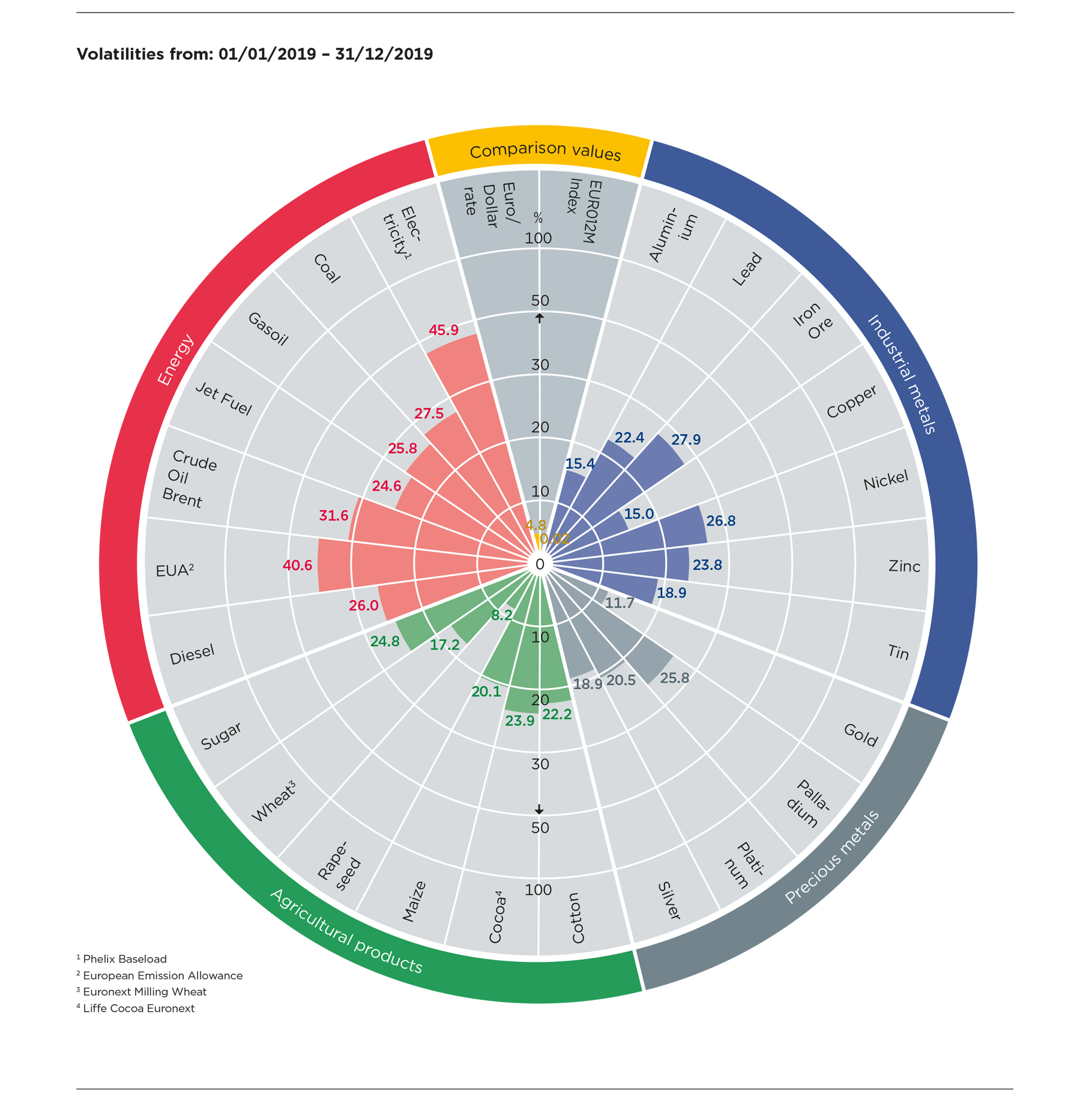

Commerzbank Commodities Radar - 4th Quarter 2019

Source: Bloomberg data

Diesel: current price weakness will not be sustained

Diesel prices rose significantly at the beginning of the year, but then came under even stronger pressure. The deciding factor for the temporary price rise was the strong price increase on the crude oil market, which was however quickly followed by a correction. More recently, demand concerns due to the outbreak of the coronavirus prevailed. The slump in diesel prices was further intensified by a marked decline in the diesel spread.

Prices were driven by the escalation of tensions between the US and Iran at the beginning of January – which eased rapidly. Furthermore, there were no production losses because of it. Consequently, oil prices swiftly gave up their interim gains. In fact, oil price levels are now clearly lower than at the beginning of the year. The spread of the coronavirus in China – plus a growing number of suspected cases in other countries – is fuelling concerns about weakening demand for oil. In this scenario, the oil market faces an even larger surplus in the first quarter, even though the ‘OPEC+’ production cartel, which also includes Russia and several other oil-producing countries, has deliberately been keeping supply restricted for three years, in order to stabilise prices at a higher level. However, OPEC representatives have indicated that they might cut production even further. In addition, the continuing insecurity in the Middle East and the difficult situation in Libya justify the geopolitical risk premium for the time being.

Due to the ample supply situation on the oil product markets at present, the diesel price has recently been put under even greater pressure than crude oil. Lower heating oil demand because of the unusually mild weather has certainly been playing a part in this. The most significant factors, however, are the downturn in the global economy and the slowdown in world trade. This slows the highly cyclical demand for diesel. The main driver in recent decades was China's diesel demand, which now accounts for 10% of global demand but whose growth momentum has slowed noticeably. In the current year, the growth rate is likely to be roughly 100,000 barrels a day – and there is a risk that the increase in demand will be even lower, due to the coronavirus. Travel and commercial activity to, from and within China is already severely restricted. Demand in the second emerging market, India, is also growing only at a moderate pace. And last but not least, Europe – as a traditionally important sales market – is suffering: the economy will stabilise only gradually during the course of this year. The situation is exacerbated by the slump in demand for passenger cars, given the loss of trust in diesel as a propulsion technology.

Against the background of weak diesel demand, stricter thresholds for the maximum sulphur content of marine fuels (under the IMO2020 regulation, which has been in effect since the beginning of the year) have yet to show any visible effect on prices. What used to be seen as the biggest fundamental change on the market for mineral oil products seems to have been dwarfed, at least for diesel. In the wake of IMO2020, such a strong surge in demand for marine gas oil was initially expected that, despite the relatively minor importance of marine gas oil overall, a tightening on the diesel market was anticipated. But as it turns out, both the demand side (shipping companies) and the supply side (refinery operators) have prepared much better than anticipated only half a year ago. Firstly, more vessels than originally expected have been fitted with scrubbers, allowing sulphurous bunker fuel to continue being used for just under one-fifth of daily fuel demand for vessels, which totals 4 million barrels. In addition, a new type of marine fuel (very low sulphur fuel oil – 'VLSFO') seems to be establishing itself quickly on the market. Moreover, refining capacity has grown significantly, especially in China, leaving some room to manoeuvre. China, for instance, has already exported large amounts of diesel, not least due to weaker domestic demand, as mentioned above. In fact, Chinese diesel exports are likely to increase even further, and a similar situation might apply to India.

Nonetheless, we do not see the mini-boom in marine gas oil prices to be fading altogether. More likely, it will trigger a recovery in the diesel crackspread, which has fallen to multi-year lows recently, as stocks of marine gas oil (which are still sizeable in many ports) start shrinking. For our price forecast, this means: Thanks to the restrictive production stance of OPEC+ countries, Brent crude prices are expected to stabilise at a level around US$60 per barrel. Diesel prices are likely to recover to some extent during the course of the year, in line with the crackspread.

Source: Commerzbank Research, as of: 30/01/2020

| in EUR per unit | in EUR per unit | ||||

| Precious metals | Agricultural products | ||||

| Gold per troy ounce |

High Low |

1,410.31 1,118.24 |

Cocoa per mt |

High Low |

2,403.27 1,781.95 |

| Palladium per troy ounce |

High Low |

1,776.21 1,100.17 |

Cotton per pound |

High Low |

0.70 0.52 |

| Platinum per troy ounce |

High Low |

894.59 694.43 |

Maize per mt |

High Low |

182.75 155.00 |

| Silver per troy ounce |

High Low |

17.77 12.85 |

Rapeseed per mt |

High Low |

412.75 351.50 |

| Sugar per pound |

High Low |

0.12 0.10 |

|||

| Wheat per mt |

High Low |

207.00 153.00 |

|||

| Industrial metals | Energy | ||||

| Aluminium per mt |

High Low |

1,692.80 1,527.57 |

Brent Crude Oil per barrel |

High Low |

66.82 48.44 |

|

Copper per mt |

High Low |

5,796.23 5,012.50 |

Coal per mt |

High Low |

75.39 42.96 |

| Iron Ore per mt |

High Low |

110.19 62.66 |

Diesel per mt |

High Low |

593.87 452.62 |

| Lead per mt |

High Low |

2,058.20 1,574.10 |

Electricity per MWh |

High Low |

56.56 30.81 |

| Nickel per mt |

High Low |

16,509.93 9,471.01 |

EUA per tonne |

High Low |

30.20 19.20 |

| Tin per mt |

High Low |

19,302.96 14,213.75 |

Gasoil per mt |

High Low |

595.20 449.38 |

| Zinc per mt |

High Low |

2,682.54 1,984.66 |

Jet Fuel per mt |

High Low |

626.30 489.94 |

* Source: Bloomberg data, period: 01/01/2019 - 31/12/2019

** From the perspective of German companies, the listed commodities are generally priced in a foreign currency. For this reason, currency risks need to be considered in addition to commodity price risks.